Appeal Property Tax in Texas – Protest deadline May 31

April and May are important months for homeowners seeking to minimize their taxes by filing a property tax appeal.

- The appraisal district values will be completely released throughout the month of April.

- Property tax protests must be submitted by May 31.

Find out if you have a case for lower property taxes by checking your 2014 assessed value using our Assessment Evaluator.

How to Appeal Property Taxes in Houston | A 90-second Video Demo for contesting property tax values

Property Tax Protests Made Easy from PropertyTaxReduction.

Learn more about Property Tax Reduction services:

- Property Tax Reduction Services | What You Get

- About PropertyTaxReduction.com | Â An online Property Tax Appeal solution

How to appeal property tax assessments at your Appraisal District:

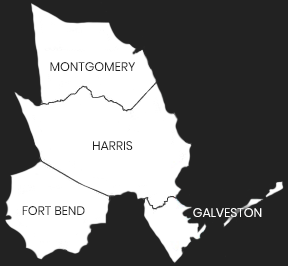

- Property Tax Protest in Sugar Land and Katy (Fort Bend County – Appeal FBCAD)

- Property Tax Protest in Conroe, The Woodlands, and Kingwood (Montgomery County – Appeal MCAD)

- Property Tax Protest in Galveston and Kemah (Appeal Galveston County)

- Property Tax Protest in Pearland and Friendswood (Brazoria County – Appeal BCAD)

[DKB url=”https://secure.propertytaxreduction.com” text=”Am I Overpaying?” desc=”” color=”orange” title=”30-second tax evaluation” type=”normal” style=”gradient” height=”10″ width=”130″ opennewwindow=”no” nofollow=”” textcolor=”white”]

100% RISK-FREE GUARANTEE

We guarantee success of your protest or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308