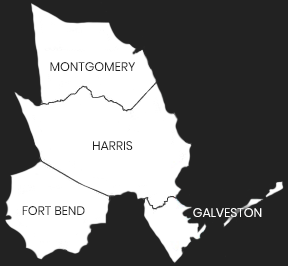

Contesting property tax appraisals in Harris County

Most of the Harris county values are available, however some are still pending. For this reason, our system is loaded with 2013 values until all the 2014 values are released.

Find out if you’re over-paying and we’ll automatically analyze your property and email the results straight to your inbox. This helps you find out if it’s worth contesting your property tax appraisal, and how much you could potentially save.

Check out these links for more help conesting property tax:

- Property tax protest evidence – get property tax relief with proven, professional evidence

- 3 Step Strategy for lowering Texas property taxes

- HCAD Property Tax Protest Statistics

100% RISK-FREE GUARANTEE

We guarantee success when using your report, or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308